OUR FUNDS

Overview

We partner with select emerging investment fund managers that may otherwise remain unknown, to offer a suite of differentiated fund strategies for allocators to consider as a compliment to or replacement of current portfolio investments.

We take a strategic approach to identify and select quality funds on a timely basis that highlight the advantages of our emerging managers that can provide higher performance (from running a small fund early on, not being capacity constrained, or having a unique investment strategy), bring a new asset class to the fund market, or provide access to niche too small for larger asset managers.

Asset Management

| Asset Manager | Fund Name | Strategy | Fund Inception | FundSERV | Monthly Update |

|---|---|---|---|---|---|

| Active Mortgage Fund | Mid-Market CDN Core & Core+ Floating Rate Real Estate Debt | Jan 2017 | ||

| Ascender Asia Fund | Actively Managed Asia Small Cap Quality Factor | Jan 2022 / Dec 2012 | ||

| Kinsted Strategic Growth Pool | Multi-Manager Multi-Strategy Private Equity | Nov 2019 | F:VPM658 A:VPM656 | |

| Kinsted Strategic Income Pool | Multi-Manager Multi-Strategy Private Credit | July 2019 | F:VPM458 A:VPM456 | |

| Kinsted Real Asset Pool | Multi-Manager Multi-Strategy Real Assets – Infrastructure, Real Estate, Timber, Agriculture | Nov 2019 | F:VPM558 A:VPM556 | |

| Pinnacle Lifestyles Fund III Incorporated | Roll Up Strategy of existing British Columbia Private Camping and RV Properties | Aug 2021 | Corporation Class A Common Voting Shares | |

| DaVinci Alternative Income Fund | Private Real Estate | Jun 2010 | F: GCC102 A: GCC999 | |

| Alignvest Student Housing REIT | Purpose-built student accommodation (PBSA) Private Real Rstate | Jun 2018 | F: ASH100 A: ASH101 | ||

| WaveFront Global Investment Program | Managed Futures | Feb 2007 | F: AHP1110 | |

| WaveFront All-Weather Fund L.P. | Absolute return | Dec 2019 | WAF100 |

Showcase Webinar Series

Introduction to the Manager(s):

Institutional Mortgage Capital:

We are pleased to introduce you to our private debt specialist focused on the Commercial Mortgage space in Canada.

Upon reviewing the IMC story, and looking at the firm’s Active Mortgage Fund (AMF), we are confident you will come to the same conclusion we have, which revolves around some key characteristics:

- Great “pedigree” and longstanding expertise and track record in the space

- Well entrenched industry participation and contacts, enabling meaningful sourcing opportunities, as well as allowing for an excellent track record of both origination and risk management

- An attractive yield level for the risk assumed, with no duration risk to speak of, given the “floating rate” nature of the portfolio + ultimately, an impressive track record of both attractive returns, at the cost of negligible volatility.

The key conclusion? IMC has both the history of success and processes / infrastructure in place to scale up from here – as well as the opportunity to do so immediately ahead.

In a nutshell, IMC fits the key Arbutus criteria of being both “good and different”.

AMF – an attractive complement to your Real Estate related exposure overall, allowing you to entrust specialists with both diversifying your exposure across Canada and across sub- categories of Commercial Real Estate, as well as – ultimately, looking to either earn attractive cash returns, or compounding same at an attractive rate.

Ascender Capital

- is a Small Cap Asia focused manager

- Ascender looks for opportunities – opting to “pounce” when dynamics have conspired to throw the valuation of its target out of whack with their longer term fundamentals

- Ascender is a manager entirely focused on a bottom up approach, looking to quality and value as core elements of its discipline, to which it seeks to add companies that a) don’t require capital b) generate strong cash flows c) aren’t covered – which represents a significant pool of opportunities for its PMs and analysts

- It should be noted that in addition, Ascender includes Japan into its “universe”, and typically will look to asset light / service oriented businesses with meaningful “moats”

Combined, these attributes justify for us the notion of Ascender being both good, AND different – the key characteristics entering into our decision process at Arbutus, when deciding to work with a manager 🙂

Kinsted Wealth

Kinsted Wealth is looking to lead the charge when it comes to providing Canadian Allocators/Advisors and their clients with access to institutional grade quality multi-manager private assets; namely private equity, private debt and real assets.

Offering 3 distinct pools (Real Assets; Strategic Equity; and Strategic Income), Kinsted builds diversified portfolios for each, providing access, due diligence, and portfolio construction that its own private clients have accessed for close to 5 years already.

In a world where “access”, relationships, robust due diligence and analytics are key, we expect Kinsted to lead the industry toward greater adoption of “privates” – which allows Canadian Allocators/Advisors to access enhanced diversification; attractive returns (including “illiquidity” premium); and ultimately strong risk adjusted returns.

Your book, and your clients’ portfolios will potentially be better off as a result of including “privates” into the mix is our view. Being able to access the diversification, access, and due diligence performed by Kinsted can make Private Assets more attainable for all investors – and further the democratization of access to alternative asset and strategies.

In our books, the above is what makes “good and different” as an asset manager to consider – you’ll agree, we trust.

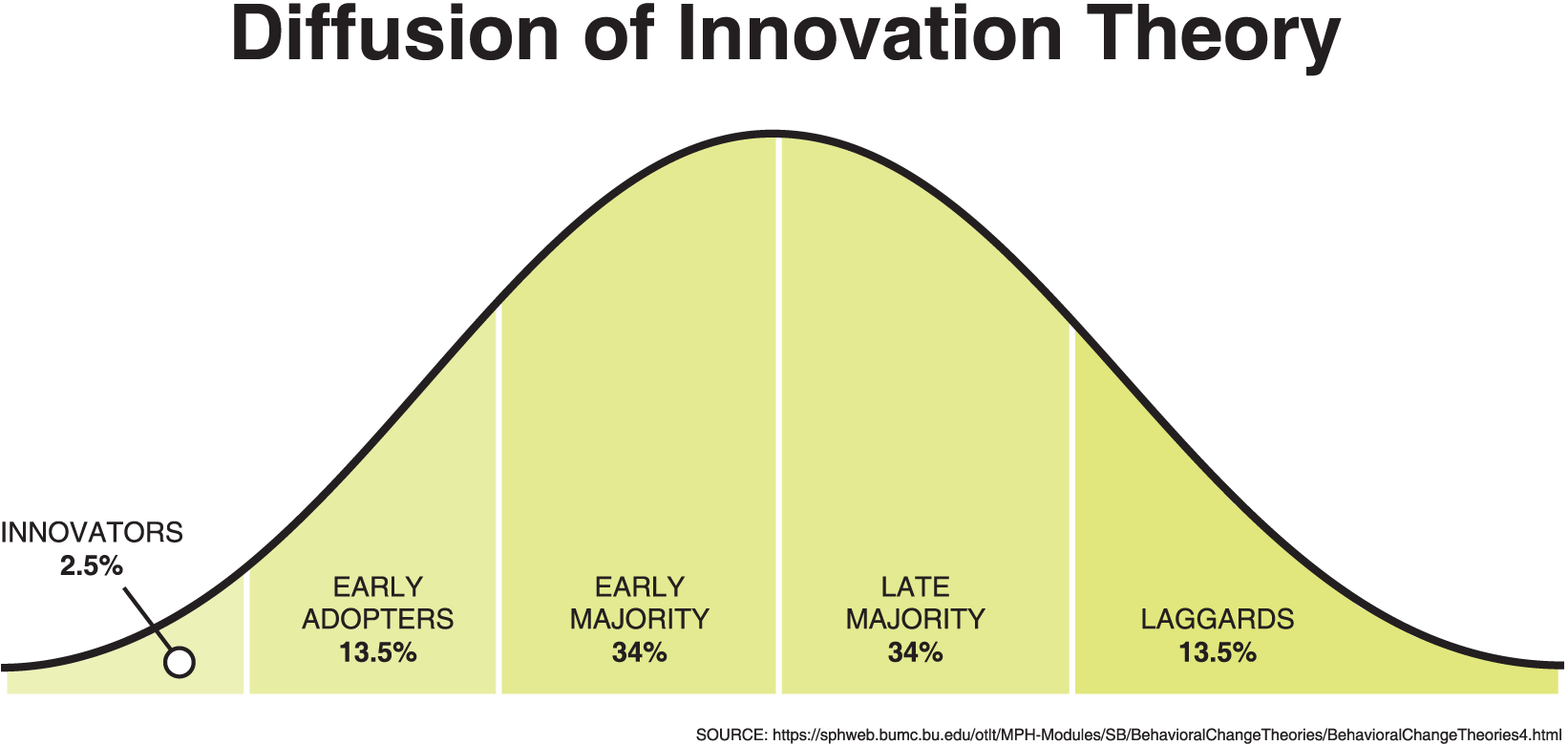

Our investment fund experience has taught us that one of the oldest social science theories is very applicable to the investment fund industry. The Diffusion of Innovation Theory was developed by Everett Rogers in 1962 to explain how, over time, an idea or product gains momentum and diffuses (or spreads) through a specific population or social system.

The end result of this diffusion is that people, as part of a social system, adopt a new idea, behavior, or product. Adoption means that a person does something differently than what they had previously (i.e., purchase or use a new product, acquire and perform a new behavior, etc.). The key to adoption is that the person must perceive the idea, behavior, or product as new or innovative.

Our allocator relationships are mostly Early Adopters and the Early Majority.

Early Adopters – These are the opinion leaders. They enjoy leadership roles and embrace change opportunities. Early Adopters are also called “lighthouse” customers or visionaries as they serve as a beacon for others to follow.

Early Majority – They adopt change before the average person and typically need to see evidence like success stories from the early adopters. This group are also called pragmatists.

Factoid- we see a lot of category similarity between our asset manager clients, our allocator relationships and ourselves

Why Work With Us

For allocators, we provide a respectful and professional relationship opportunity for your portfolio solutions to stay ahead of competitors and differentiate your business practice. We firmly believe part of an allocator’s role is to stay aware of investment trends and short list funds and asset managers to consider presenting to investors. The experience of finding one of tomorrow’s emerging manager winners today can make a significant legacy difference in both our car