About Emerging Managers

What are they?

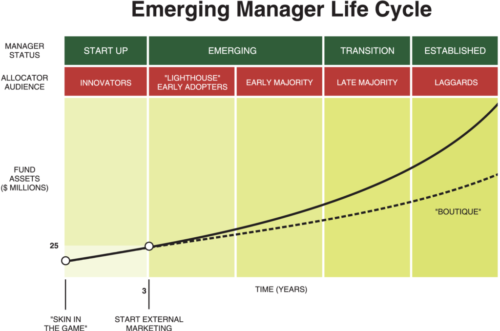

Emerging Managers to us are asset managers who have graduated from the start-up phase of a funds growth, with an established track record and a critical mass of assets at the fund level.Some consider a newer smaller fund from a large asset manager to be an emerging manager but that is not our focus

In other geographies, emerging managers and diverse managers are looked upon separately. In our country of business, these two terms are generally ubiquitous.

Many startups in our space are break away managers who left a larger parent organization.

Emerging managers either aspire to become a transition manager on the way to an established manager or evolve into a boutique.

“We don’t particularly like the term emerging managers, which is a highly institutional phrase. What we mean is newer managers who are less established and less proven as investors. However, we haven’t yet come up with an equally pithy phrase to convey that!”

Joel Cohen

Global Investment Staff,

MIT Investment Management Company

Why Emerging Managers?

The attraction of emerging managers is based on one of three opportunities they provide:

- Higher performance. From running a small fund early on, not being capacity constrained, or having a unique investment strategy.

- A new asset class to the fund market,

- or Access to niche too small for larger asset managers

The attractiveness of funds from emerging managers is usually caused by the fact that smaller size and an early stage or in a new asset class usually allows for portfolio complimentary performance (lower correlation, potentially attractive performance, attractive tax structure, and lover volatility) to the rest of the portfolio.

Why Consider Investing?

Simply put, the experience of finding one of tomorrow’s emerging manager winners today is worth the pursuit for the difference it can make to an allocators portfolio through increased returns, reduction of overall risk or increased portfolio income potential.

Such winners manifest themselves by likely raising the efficient frontier from which model portfolios are selected.

Through the lens of the improved performance opportunity emerging managers benefit they can offer, the following research provides views from different perspectives.

Research: Emerging Manager vs. Established Firms

According to a Preqin study, first-time funds have generally posted superior returns during their first three years compared to the first three years of funds launched by veteran fund managers (source). According to the study, since 2007 the average emerging manager long/short fund returned 8.8% net of fees in its first three years of trading while established managers returned 5.38%. However, emerging managers produced more volatile returns compared to established managers. The Sharpe Ratios of the returns, which is the industry standard for calculating risk-adjusted returns, are similar for both emerging and established managers across all strategies according to Preqin.

Why do some emerging managers outperform established managers? In order to survive, emerging managers need to outperform their peer group to attract assets and build their business. While many emerging hedge funds die, the ones that survive tend to perform above average compared to established managers. Additionally, emerging managers tend to be more nimble in making investment decisions while also lacking the big bureaucratic and approval structures inherent in bigger firms. The smaller manager can also invest in smaller investments that are simply too small for multi-billion-dollar managers.

Research: Emerging Hedge Fund - Preqin

A veritable cornucopia of research points to the benefits of investing with funds a bit off the beaten path. But investors are like dieters — knowing what’s good for them doesn’t make them do the right thing.

Preqin announced in July 2017 that hedge funds with less than $300 million in assets under management, as well as funds with track records of less than three years, posted higher returns on a one, three, and five-year basis. A February 2017 study found that 31 percent of first-time private-equity funds landed in the top performance quartile, while another 23 percent landed in the second quartile. (source)

Research: Emerging Hedge Fund - HFR Inc.

An admittedly dated (2005) Hedge Fund Research Inc article is shared below to reinforce the overall benefits of emerging hedge fund managers only.

Hedge Fund Research Inc analysis confirms that new hedge funds tend to outperform established funds in their initial years, particularly when run by new managers

Emerging managers, defined as managers with less than a two year track record, represent nearly 10% of the hedge fund universe based on assets under management. Emerging managers exhibit compelling absolute return profiles and have typically outperformed the overall hedge fund market. There have been numerous articles published over the past few years documenting the out-performance of newer funds, particularly in their first two years, but HFR has advanced this analysis to identify the greater performance potential from new managers versus established managers launching new funds

Emerging managers can offer significant potential to a core hedge fund portfolio, offering alpha-pursuing strategies driven by:

· Greater incentive of young managers to outperform in order to attract assets

· The nimble nature of smaller funds to focus on their best investment ideas

· The application of specific expertise to niche markets (Source)

What about Emerging Manager risk?

As with any investment opportunity, any balanced research must consider risks.

For sure from a brand and familiarity perspective, emerging managers are lesser-known or undiscovered and therefore viewed as riskier than established managers and generally, they are.

However, consider this perspective in the small vs. large manager debate:

“Well, risk is there whether you’re small or large. No one was too concerned about risk when they spoke about Merrill Lynch, Countrywide, Lehman Brothers or Bear Stearns.”

Juan Martinez,

Vice President and Chief Financial Officer

John S. and James L. Knight Foundation

With Increased Opportunities Come Increased Potential Risks

Research stated that ~40% of new hedge funds did not survive past 3 years. We take this to be a good benchmark for any new fund, and therefore supports our general request to only work with funds that have a minimum $25 Million in assets and minimum 3 year verifiable track record.

With Increased Opportunities Come Increased Risks – 2 in particular to know

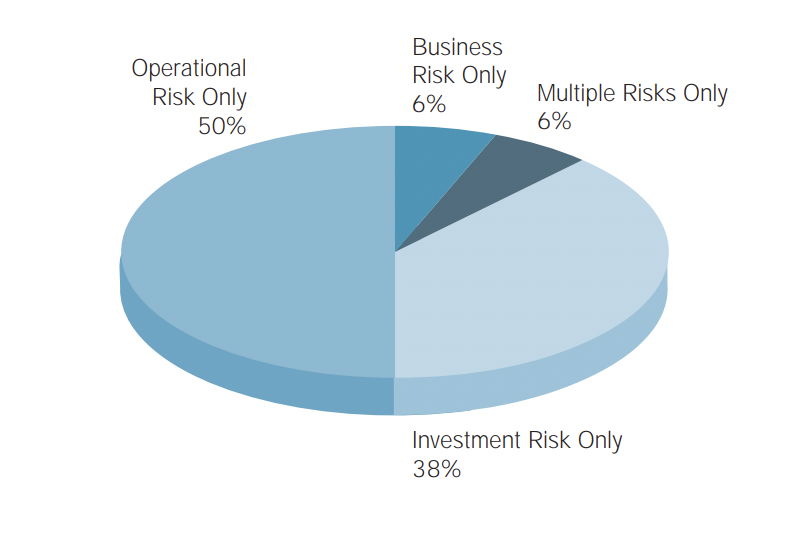

A research study by The Capital Markets Company provides a good perspective we believe still applies today. The following pie chart provides a good visual representation of emerging manager risk for manager selection criteria, not just for hedge fund strategies.

Operational Risk and Investment Risk combine to equal 88% of the risks categorized. We feel that investment risk applies to any strategy from any asset manager of any size, so we’ll focus on operational risk as it applies to this educational about emerging managers.

Operational Risks Examples

1. Misrepresentation of Investments: False or misleading reporting of investment valuations

2. Misappropriation of Funds: Removal of money from fund either as outright theft or to hide trading losses

3. Unauthorized Trading & Style Breaches: Investments made outside of stated fund strategy without investor approval

4. Inadequate Resources: Technology, processes or personnel unable to handle operating volumes

Sadly, if one has been investing or in the investment industry long enough, you have likely read about actual examples of these risks or worse directly effected along the way of being deemed “experienced”.

This section is intended to provide education and a balanced view of what emerging managers are about.

For our own efforts, the Arbutus manager selection process includes applying our experience and industry contact knowledge to every client we represent.

Educational Resources

Emerging Manager Events

Emerging Manager Programs

https://www.pgeq.ca/en

https://www.trs.texas.gov/Pages/investment_team_emerging_managers.aspx

Canadian Association of Alternative Strategies & Assets (CAASA)

The Lyon’s Share Series: A look at emerging managers

CAASA NowTalk features a pioneer in the fund marketing and placement business – especially now with his role of introducing new and emerging asset managers to advisors.

Play Episode 2 – February 15, 2022

Guest: Mark Irwin, DaVinci Capital Partners

In this chat Grahame speaks to the emerging manager scene in Canada & features a real estate manager that is growing its portfolio via returns, new investors, and additional allocations from current ones.

____

DaVinci Capital Partners – An Agnostic View of North American Real Estate (recorded webinar)

Guest: Mark Irwin & Jim Goren, DaVinci Capital Partners